Mortgage closing costs can be defined as the fee you pay for the services you acquire when you secure a loan for refinancing or purchasing a new property. In simple words, before you get the keys to your new house, you need to sign some documents to officially transfer the homeownership to your name. Throughout the entire property purchasing process, third parties such as mortgage lenders and real estate attorneys have provided you with significant services that played a vital role in closing a real estate deal.

The closing costs comprise the fee of these professionals and charges of other services that were required to finalize your home loan and the real estate transaction. Here is everything you need to know about mortgage closing costs.

What Is Meant by Closing Costs?

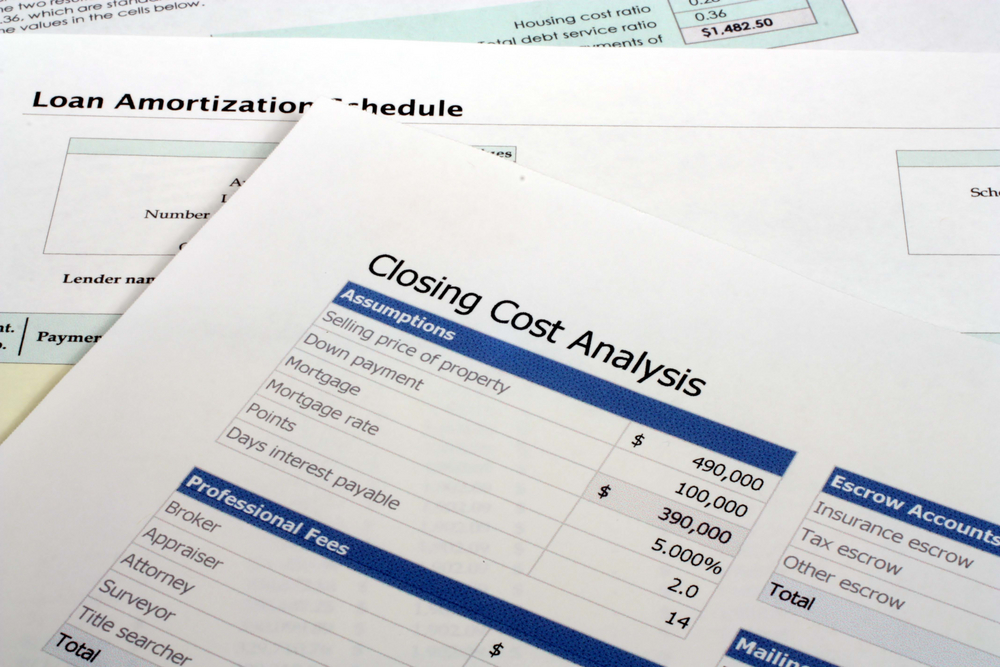

The total sum of the myriad fees for expenses and services required to finalize a mortgage, the closing costs typically range from 3% to 6% of the property price. This means that if you purchase a house for $300,000, the closing costs would be $6000 to $15000. Note that the closing costs might vary depending upon the loan type, mortgage lender, and your state. Therefore, always pay attention to the real estate laws of your area when calculating the closing costs.

Significance of Closing Costs

You’re almost certainly already making a down payment, as well as an earnest money deposit as a substantial mortgage payment for the foreseeable future and to demonstrate good faith.

A real estate transaction is a complicated process involving several moving elements and players. Some states require additional inspections in which you pay a home inspector of your choice directly. Then there are insurance, transfer and property taxes, and other costs discussed below.

Types of Fees with Closing Costs

Here are some standard closing costs which you might be charged on the closing disclosure and loan estimate:

Attorney Fee

It is charged by a real estate attorney to develop and review the property purchase contract and agreements. Note that only some states require an attorney to handle the real estate transaction.

Application Fee

This covers the cost of processing your request for the loan, including administrative expenses and credit checks. The amount of the application fee might vary depending upon the lender and the complexity level of your mortgage request.

Courier Fee

The courier fee helps in expediting the transportation of documents. Note that you won’t be charged the courier fee if the closing is handled digitally.

Closing Fee

It is paid to the third party (Attorney, Title Company, or Escrow Company) who handles the deal’s closing. The closing fee is also known as the Escrow Fee.

Escrow Deposit

The escrow deposit includes the mortgage insurance payment and the property tax for two or three months. Some lenders might ask you to pay it in the form of a security deposit in an escrow account.

Credit Report Fee

The fee that a lender charges to pull your credit reports from the three main bureaus is known as the “Credit Report Fee.” The typical amount of the credit report fee is $15 – $30.

FHA Mortgage Insurance Premium

In case you are signing up for an FHA loan, note that it requires a UPMIP (Upfront Mortgage Insurance Premium) which is 1.75% of the base loan. Moreover, you might also be required to pay an annual MIP payment which is 0.45% to 1.05%, depending upon your base amount and the terms and conditions of the loan.

Homeowners Association Transfer Fee

Whether you invest in a property, a townhouse, or a condominium, you must become a part of the HOA (Homeowners Association) community. The homeowners’ association transfer fee covers the cost of switching ownership from the seller to you (buyer).

Flood Determination and Monitoring Fee

The fee charged to a flood inspector to make sure that your property isn’t in the flood zone is known as the “Flood Determination and Monitoring Fee.”

Homeowners Insurance

Some lenders require the buyers to invest in the homeowners’ insurance premium to protect their property against vandalism and other unforeseen mishaps. The amount will vary depending on your property’s value and where you live.

Lead-Based Paint Inspection

If the property that you are buying was constructed before 1979, having a lead-based paint inspection is a must. Pay a certified inspector to check your property for hazardous lead contamination.

Lender’s Title Insurance

Otherwise known as the loan policy, the lender’s title insurance will protect you if there is an error in the property’s title search, the documents are forged, or someone else claims ownership of the home after its fold. The lender’s title insurance will only last until the loan is paid off.

Discount Points

One point equals 1% of the loan amount. Discount points help in reducing the interest rate of the loan, hence lowering the monthly payment.

Pest Inspection

As the name suggests, the pest inspection fee goes to the professionals who make sure that your new home is dry rot, termites, and pests-free. A pest inspection can cost you around $100.

Origination Fee

The origination fee is 1% of the amount of the loan that you have applied for. It covers the lender’s administrative cost and other monthly charges. The lenders who don’t charge an origination fee have a higher interest rate.

Owner’s Title Insurance

The owner’s title insurance is 0.5 to 1% of the purchase price. It is required to protect you in case someone challenges your ownership of the property.

Property Appraisal Fee

The property appraisal fee is somewhere between $300 and $500. It is paid to the professional home appraisal company to determine the loan-to-value ratio and assess the property’s fair market.

Wrapping It Up!

The most cost-effective way to cover closing costs is by considering them as a one-time expense and paying them straight out of your pocket. Even though folding the closing costs in a loan might seem like an efficient, timely solution, the interest might end up burning a hole in your pocket. Therefore, do your research and organize all your finances before paying up the closing costs.